A while back I was helping a client create a debt repayment plan and I found a great free tool that I’d like to share with you today.

If you have student loans, credit cards, a mortgage, or any other debt that you’re working to pay off, this tool will help you do it as quickly and effectively as possible. Specifically, it will help you:

- Organize your various debts in one place

- Determine the exact order in which to prioritize your debts

- Figure out exactly how much money to put towards each debt every single month from now until the last one is paid off

- See how much money you can save by putting extra money towards your debt and/or prioritizing them the right way

Below I’m going to walk through the most helpful features of this tool so you can see how it works. But first, here are the links to get it for yourself:

- Excel version: Vertex Debt Reduction Calculator (Excel)

- Google Sheets version: Vertex Debt Reduction Calculator (Google Sheets)

Let’s dive in!

Quick note: The free version can handle up to 10 loans. If you have more than that, there’s a paid version that costs $9.95 that can handle up to 40 loans. You can get it here. (And no, I’m not affiliated with this company and don’t get paid to recommend them.)

The 3 most helpful features

The spreadsheet comes with a full set of directions that you can follow to fill it out yourself. I’m not trying to duplicate those directions here, but I would like to give you a sense of how this tool will help.

Here are the three features that I think are most helpful.

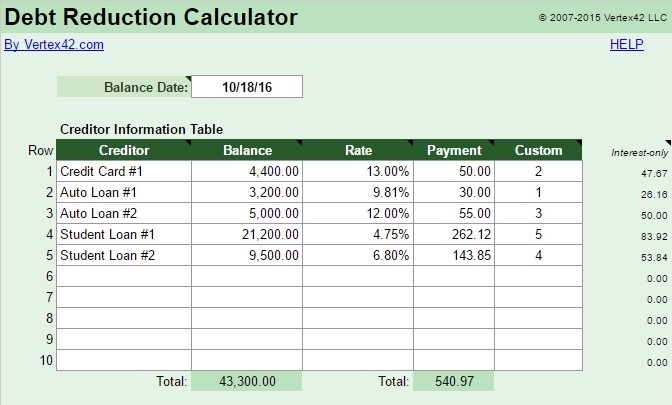

- Debt organizer

This is where you enter the important information about your debts. This information is used for the rest of the calculations in the spreadsheet, but it’s also useful simply because it organizes everything in one place. As I talked about a in my last blog, sometimes simply being aware of your financial situation is all you really need to make progress, and this is a big step in that direction.

One of the most helpful pieces here is the Total line, which shows you both your total debt balance and your total monthly payment.

- Repayment strategy

Once you’re organized, it’s time to decide two important things about your debt repayment plan:

- How much you can afford to put towards your debts each month

- How you’d like to prioritize your debts

One of the cool parts about this tool is that it’s easy to play around and see how making different decisions here will lead to different outcomes. This allows you to make a decision you actually understand and like instead of having to blindly trust “the experts”.

For instance, here’s what it looks like in my example when I choose to make the minimum payment on all debts and prioritize the lowest balance debts first:

As you can see, my last debt will be paid off in June of 2026 and I’ll pay $18,933.10 in interest between now and then.

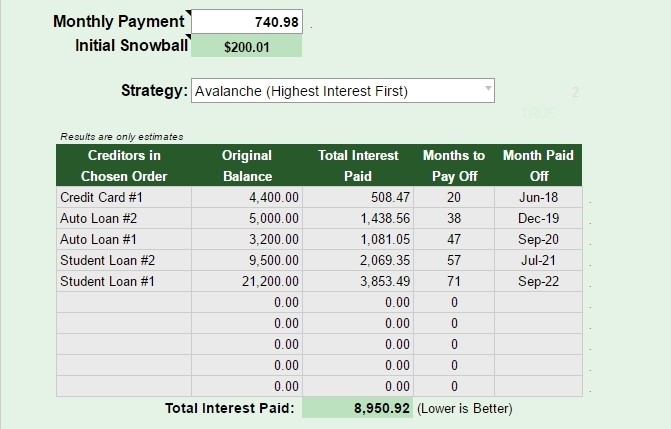

Now let’s say that I can afford to put an extra $200 per month towards my debt. How does that change the results?

That extra $200 per month means I’ll be debt-free almost 4 years sooner AND I’ll save over $9,600 in interest. Pretty cool!

But your payment isn’t the only variable you can play around with. You can also change the order in which you pay off your debts, so let’s see what happens if we decide to pay the highest interest debts off first:

You’d get to debt-free at the same time as the example just above but you’d save yourself about $300 along the way. It’s not a big difference in this example simply because the highest interest debts are also the debts with the lowest balances, so it ends up being about the same either way. In other situations the difference could be much bigger.

I would play around with both of these variables to see how they affect your end result. Then you can make an informed decision based on actual numbers.

Quick note: Do you want real answers to your personal questions about paying off debt and other financial issues? Click here to learn how to get them.

3. Payment Schedule

This one is pretty cool.

The screenshot above is from the bottom part of the PaymentSchedule tab of the spreadsheet, and while it might look a little intimidating at first, what it’s doing is really helpful.

This is where you can see exactly how much money you’ll put towards each debt every single month from today through your very final debt payment, customized to the specific strategy you chose in the last step.

What this means is that you don’t have to figure out all these payment amounts yourself. If you simply make the payments each month exactly as they’re laid out here, you’ll get to debt-free right on schedule.

This is especially helpful during the months when you pay off a debt. For example, in the screenshot above I make the final payment on Credit Card #1 in June of 2018, which means that my payments change in both that month and the next one. And instead of me having to run those numbers myself and hope I get them right, I can simply follow the directions here.

How I would use this tool

All of the features above are very cool and very helpful, but of course you still have to use this information to take action. Without action, none of this will actually lead to anything.

Here’s how I would use this tool, both immediately and on an ongoing basis:

- Download the spreadsheet and follow the steps above to create your initial debt repayment plan.

- Automate both your minimum payments and the extra payment you’re making towards whichever debt you’re prioritizing first. You can use the Payment Schedule tab to figure out exactly what those amounts should be.

- Schedule a reminder using Google Calendar (or any other tool) to update your automated payments for all months where the Payment Schedule indicates a change.

- Any time you make an extra one-time payment, need to pay less one month, or anything else about your plan changes, update the spreadsheet to reflect your new situation so you can update your plan.

If you follow those steps, you’ll be well on your way to debt-free.

If at any time you need help, have questions, or are ready to have some guidance into your financial future, please don’t hesitate to reach out. Practical Planner is not a stuff bank or wealth management office, we are pushing investments or insurance, we don’t wear expensive suits and ties… we are everyday people, parents, friends, neighbours just like you. Please book an appointment or send an email Contact@practicalplanner.ca